UniSuper’s response to our open letter

16 May 2020

Exactly one month after we sent the UniSuper Divest open letter, on behalf of you and almost 12,000 other members, we got a response from UniSuper’s Chairman Ian Martin.

Sadly, the response rejects the open letter’s fossil fuel divestment ask, without much in the way of justification. You can read the full letter from here.

UniSuper claims “wholesale [fossil fuel] divestment is not the best approach to encouraging climate action, nor the right approach to delivering the best financial outcome for our members.”

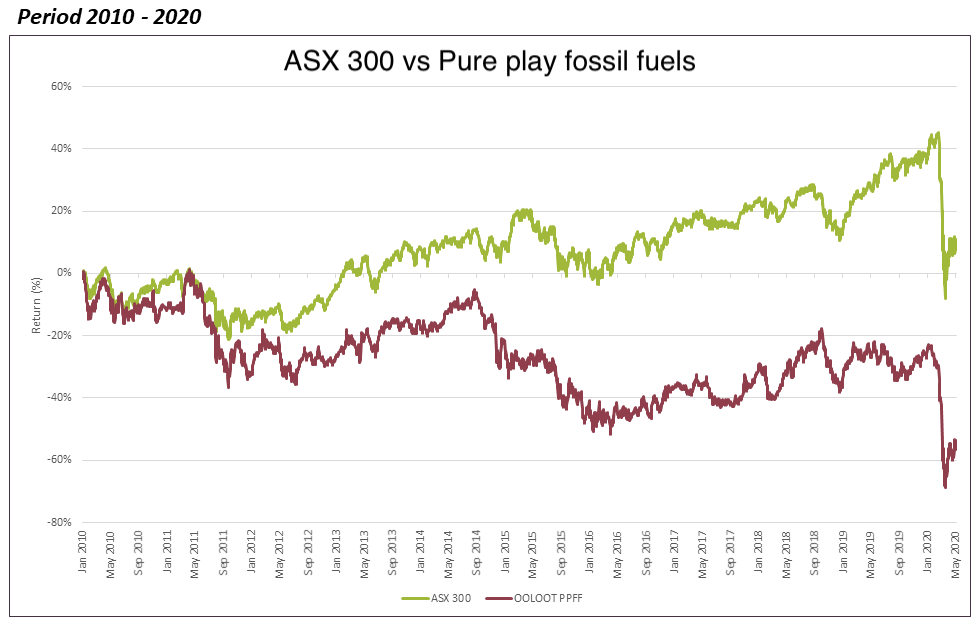

However, Market Forces’ new analysis shows the value of Australia’s fossil fuel producers has tanked over the last 10 years, a trend which has been exacerbated during the Covid-19 pandemic.

We identified 11 companies in the top 300 listed on the Australian share market (ASX 300) whose sole business is producing coal, oil or gas. An index tracking the sharemarket performance of these 11 ‘pure play’ fossil fuel companies has halved in value since January 2010, while the ASX 300 has risen 20% over that time.

Put simply, if someone had invested $100,000 in an index made up of Australia’s pure play fossil fuel producers in 2010, that investment would now be worth just $53,000.

Analysis as at close of ASX 11 May 2020

Step up the pressure

Complete this form to send a message directly to UniSuper, demanding the fund explains why it has failed to break free from dirty fossil fuel investments

Time for UniSuper to leave dirty fossil fuels behind

There is no justification for our super funds continuing to invest our retirement savings in companies that for the past 10 years have been massively losing value, all while pursuing their plans driving us towards runaway climate change and the social, economic and environmental destruction it would usher in.

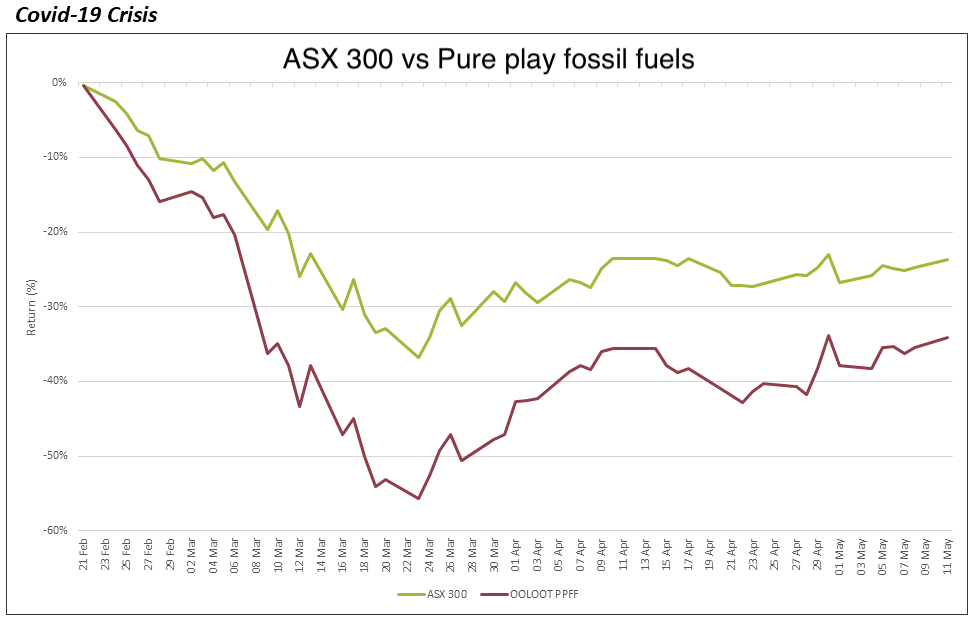

The performance gap between pure play fossil fuel producers and the rest of the market has been growing wider and wider over the last 10 years, and has been particularly severe since the Covid-19 pandemic began impacting the sharemarket. Since 20 February this year, the ASX 300 is down 24%, while the 11 pure play fossil fuel producers are down 34%.

According to the International Energy Agency, the future is looking bleak for fossil fuels. The IEA projects oil demand to fall by 9%, coal by 8% and gas by 5% through 2020, while solar is expected to grow by 15% and wind by 10%. Those IEA figures prompted industry observers Carbon Tracker Initiative to suggest 2019 was the peak of global fossil fuel demand.

It’s time for super funds to break free from dirty fossil fuel investments, and instead invest in companies that will drive the clean, sustainable economic recovery we need to see.

Chart 1: 01/01/2010 – 11/05/2020

Chart 2: 20/02/2020 – 11/05/2020

About this campaign

UniSuper DIVEST is a project of Market Forces, supported by UniSuper members across Australia. The campaign is designed to support signatories to take ownership of the campaign and organise to share it widely among fellow UniSuper members. Together we will take this campaign into the media and right to the doors of UniSuper.

UniSuper DIVEST recognises and supports the important work of the National Tertiary Education Union (NTEU) in pushing for climate action, including motions passed in October 2019 declaring a climate emergency and calling on UniSuper to divest from fossil fuels. This campaign supports these efforts and seeks to demonstrate widespread support for fossil fuel divestment among UniSuper members.

Market Forces’ research has identified the big Australian companies that are undermining climate action by expanding the scale of the fossil fuel industry and whose future is tied to worsening the climate crisis. These are the companies the open letter calls on UniSuper to divest from.

UniSuper should not be investing any of its members’ retirement savings in these climate-wrecking companies. While the fund offers investment options that exclude some fossil fuel investments, these options represent a tiny proportion of assets under management and require members to actively seek out and switch into them. Climate action is effectively quarantined to those niche options and the members that are able to find their way into them. Meanwhile UniSuper continues to invest billions of dollars in fossil fuels through mainstream investment options. UniSuper, as a whole, is still overwhelmingly backing companies that are driving us towards runaway climate change.

Learn more about UniSuper’s climate performance.

This campaign provides a platform for members to demand UniSuper divests from fossil fuel companies that are undermining the Paris Agreement’s goal of limiting global warming to 1.5°C.

Market Forces is an affiliate project of Friends of the Earth Australia. Learn more at marketforces.org.au/about